See What the

Institutions See

Access private equity, credit, and real estate fund data from public pension disclosures and SEC filings.

Data From Authoritative Sources

We aggregate publicly disclosed information from pension funds, SEC filings, and other institutional sources.

Pension Disclosures

Quarterly and annual reports from CalPERS, CalSTRS, Florida SBA, and 50+ other public pensions.

SEC Filings

Form ADV, Form D, and 13F filings providing fund details, regulatory data, and ownership info.

Normalized Database

Entity resolution and data cleaning to provide consistent, queryable fund and manager records.

Track Performance Across Vintages

Analyze IRR, TVPI and DPI across vintage years. See how different strategies perform over time with data aggregated from institutional portfolios.

- IRR, TVPI, and DPI quartiles by vintage year

- Filter by strategy and geography

- Compare manager performance over time

PRIVATE EQUITY: MEDIAN IRR BY VINTAGE (2010+)

FUNDS BY STRATEGY

Comprehensive Strategy Coverage

From buyout and venture to private credit and real estate, track fund performance across all major alternative asset strategies.

- Private Equity (Buyout, Growth, Venture)

- Private Credit (Direct Lending, Mezzanine)

- Real Assets (Real Estate, Infrastructure)

Global Geographic Coverage

Track fund performance across major geographic regions. From global mandates to region-specific strategies, understand where capital is being deployed.

- Global, multi-region fund strategies

- North America focused funds

- Europe and Asia-Pacific coverage

FUNDS BY GEOGRAPHY

Fund-Reported Performance Data

Access actual IRR, TVPI, and DPI reported by major pension systems. Every data point links back to its source document for full transparency.

- Net IRR, TVPI and DPI from pension disclosures

- Commitment and NAV values

- Source document links

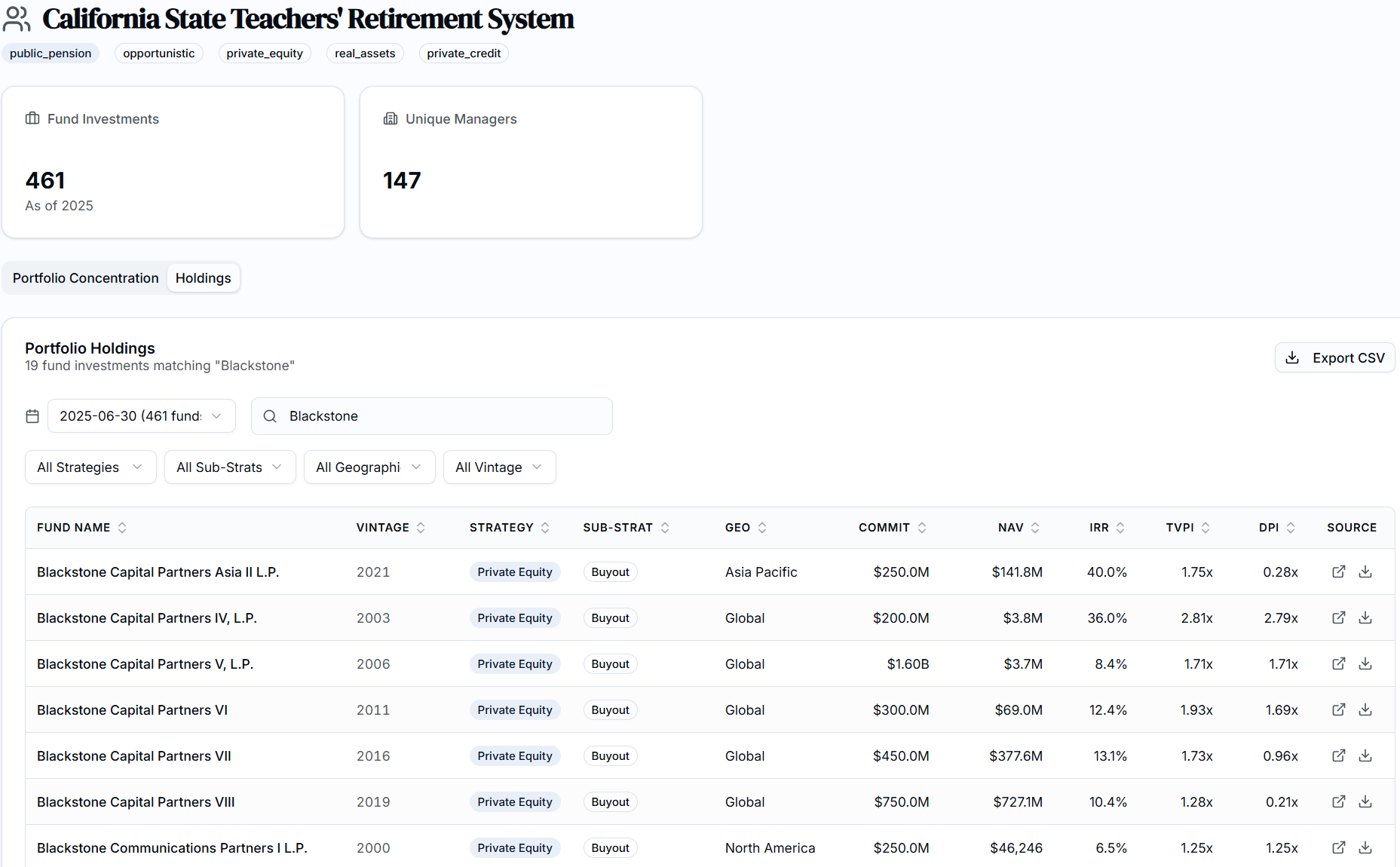

Institutional Portfolio Intelligence

See which funds major pension systems are investing in. Track commitments, performance, and allocation patterns across institutional portfolios.

- LP-to-fund relationship mapping

- Historical commitment data

- Manager re-up patterns

TOP LP PORTFOLIOS

Ready to Access Private Markets Data?

Join researchers, allocators, and fund managers using LP Data to track private market performance.